US Stocks fell -3.3% in the third quarter and experienced their first negative quarter since Q3 of 2022. While equities surged in July, the market was hit with bad news throughout August and September, starting with the downgrade of the US Debt Rating by Fitch on August 1st. Moody’s quickly followed with downgrades of several small-to-midsized banks. Other negative news included a property crisis in China, surging Oil Prices and Treasury Yields, stickier inflation, a rising US Dollar and a “hawkish pause” by the Federal Reserve.

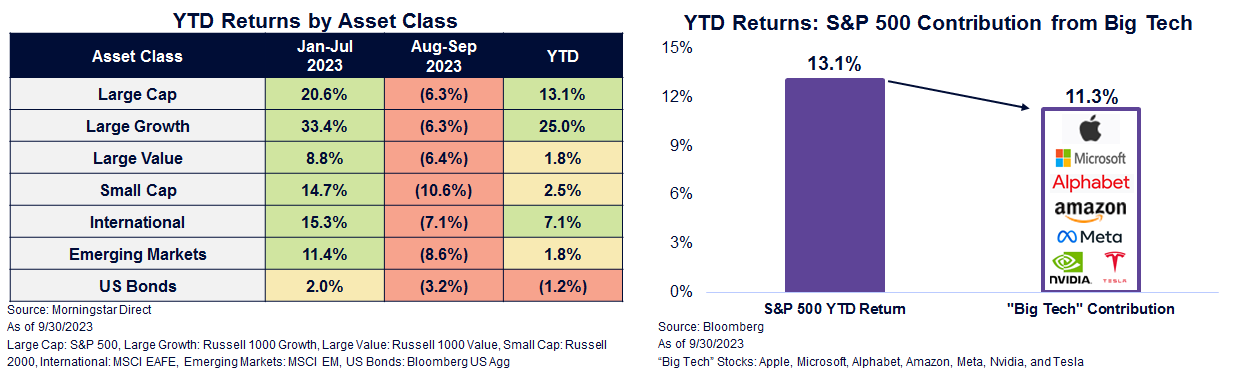

As shown below, all major asset classes experienced negative returns in August & September. International equities were hit harder than the US, in part due to a rising US Dollar and a slowdown in China. Most concerning to investors continues to be signals from the Bond Market and narrow breadth in the equity market. While the S&P 500 is up 13% in 2023, the majority of those returns (11.3%) have come from the “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla).

The Market is Sending Mixed Messages…

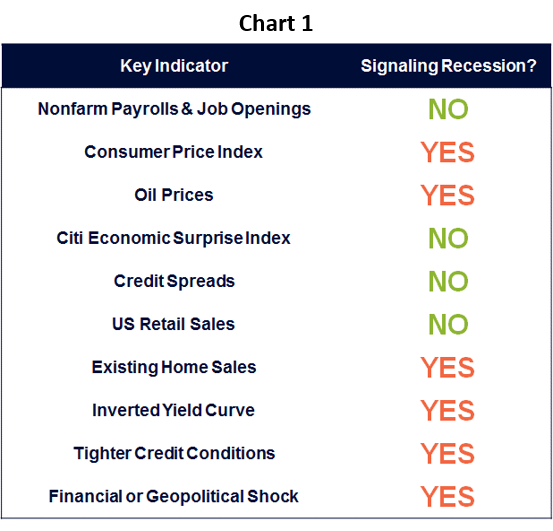

The market continues to send mixed messages regarding a possible Recession (See Chart 1), with warning signs including:

- CPI rising in September and proving to be sticker

- Oil prices hitting the highest level since November 2022

- Longest yield curve inversion on record

- Highest 2- & 10-year Treasury Yields since 2006 & 2007, respectively (See Chart 2)

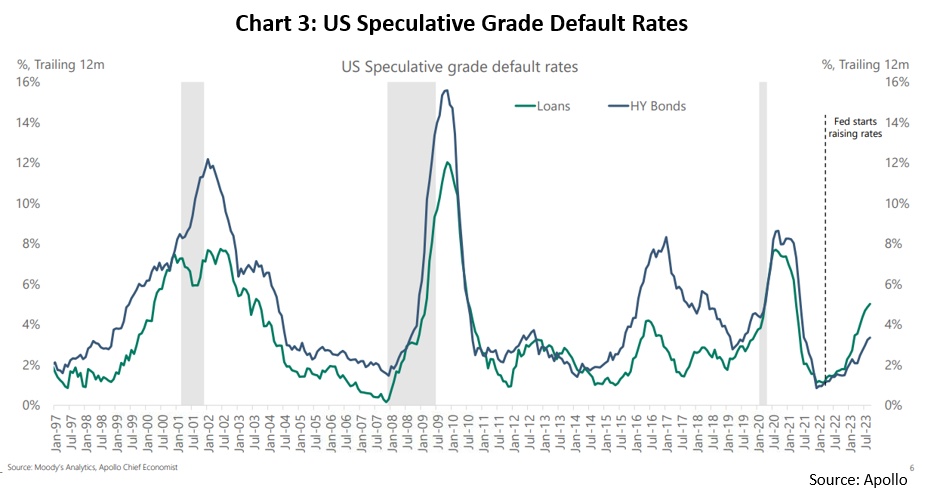

- Rising default rates (See Chart 3)

- Geopolitical shocks including the conflict in Israel and the property crisis in China

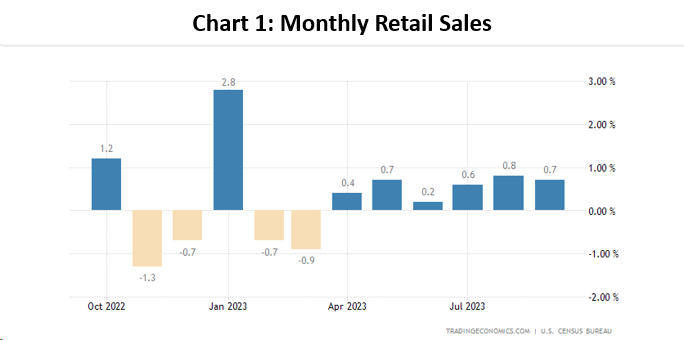

Despite these headwinds the overall economy has proven resilient, particularly the labor market and consumer spending:

- Continued strong retail sales (See Chart 1)

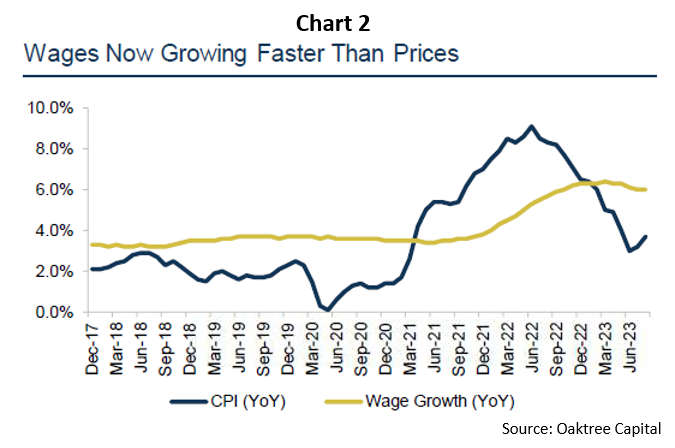

- Wages growing faster than prices (See Chart 2)

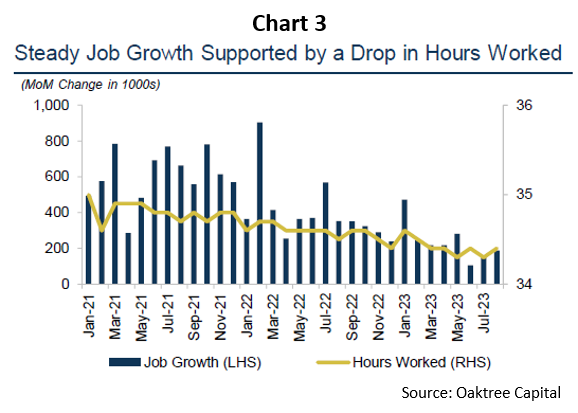

- Steady job growth supported by a drop in hours worked (See Chart 3)

- Unemployment rate below 4.0% and elevated number of job openings

- Increasing home prices despite rising mortgage rates

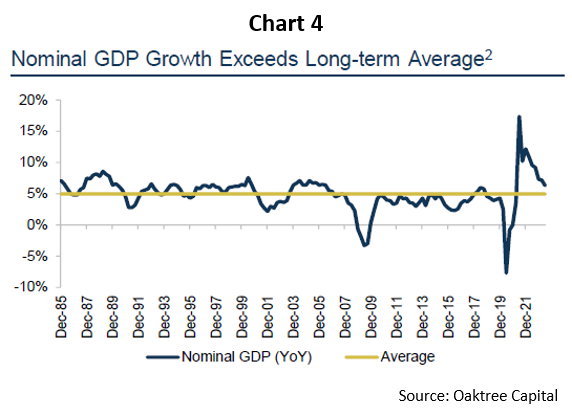

- Nominal GDP growth exceeding long-term average (See Chart 4)

- The Citi Economic Surprise Index, which shows if economic data are coming in above or below expectations, remains high – a positive sign for the economy

- Credit spreads remain relatively low

Possible Recession Timing

Monetary policy historically operates with a lagged effect on the economy. This makes it much trickier for Fed officials and investors to determine when or if a Recession may start. The Fed has raised interest rates to the highest level since 2006 and we believe the lag from higher interest rates is starting to slow the economy. As mentioned on the previous slide, we are starting to see:

- Rising Bankruptcy Filings & Credit Card Delinquency Rates

- Slowing Bank Lending & Tighter Credit Conditions

- Falling Mortgage Applications to Purchase a Home

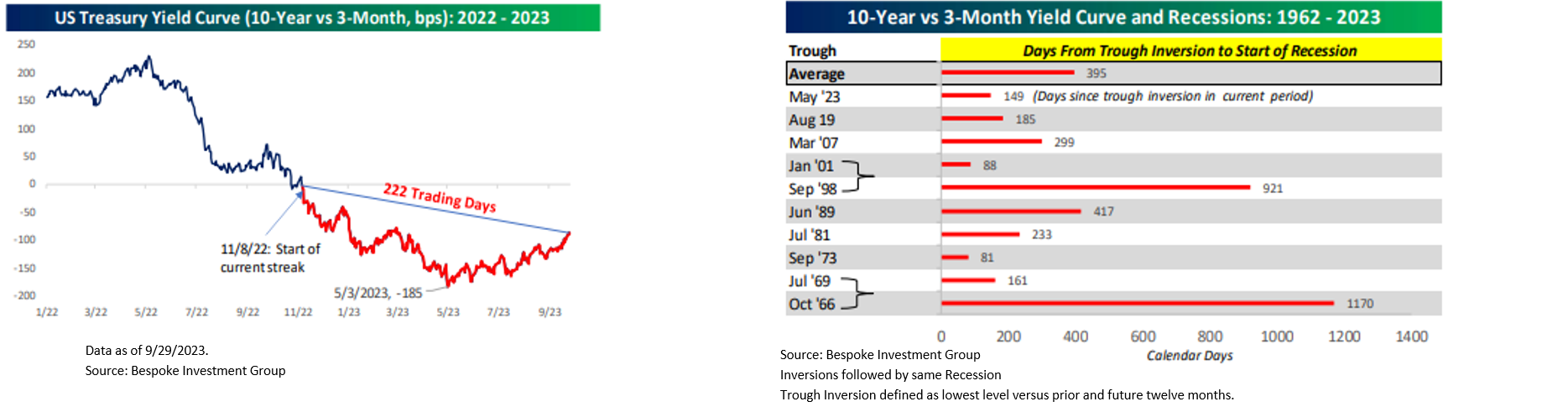

Every US Recession since the 1950s has been preceded by an inverted yield curve. The 10-year and 3-month yield curve is closely watched by investors and has been inverted for 222 consecutive trading days – its longest inversion on record. History shows a Recession begins much later after a yield curve initially inverts. In fact, the average number of days from the first date of inversion to the start of a Recession has been 589 days (dating back to the late-1960s). The current yield curve inversion reached its maximum inversion after the Regional Banking Crisis on May 3rd. Since then, the yield curve has steepened. Historically the number of days from peak yield curve inversion to the start of a Recession has averaged 395 days.

Fed’s “Hawkish Pause” Leads to Surge in Yields

While the Fed left rates unchanged at its last meeting on September 20th, Chair Powell delivered a strong message to the markets that additional rate hikes are on the table. Hawkish commentary at his press conference included:

- “The process of getting inflation sustainably down to 2% has a long way to go”

- “Majority of participants believe that it is more likely than not for us to raise rates one more time”

- “Full effects of our tightening have yet to be felt”

- “Labor demand still exceeds the supply of available workers”

Yields surged in response to Powell’s comments and the Fed’s updated “Dot Plot” – which showed 12 of 19 voting participants expecting one additional rate hike in 2023. Many participants only expect 1-2 rate cuts in 2024.

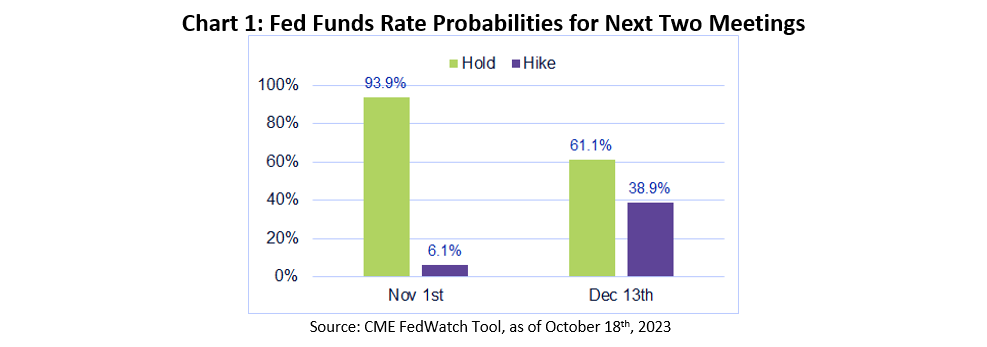

The market believes the Fed will hold rates steady at its last two meetings of the year, according to the CME FedWatch Tool. The market only sees a 6% chance of a hike at the Nov 1st meeting and a 39% chance of a hike at the Dec 13th meeting. (See Chart 1)

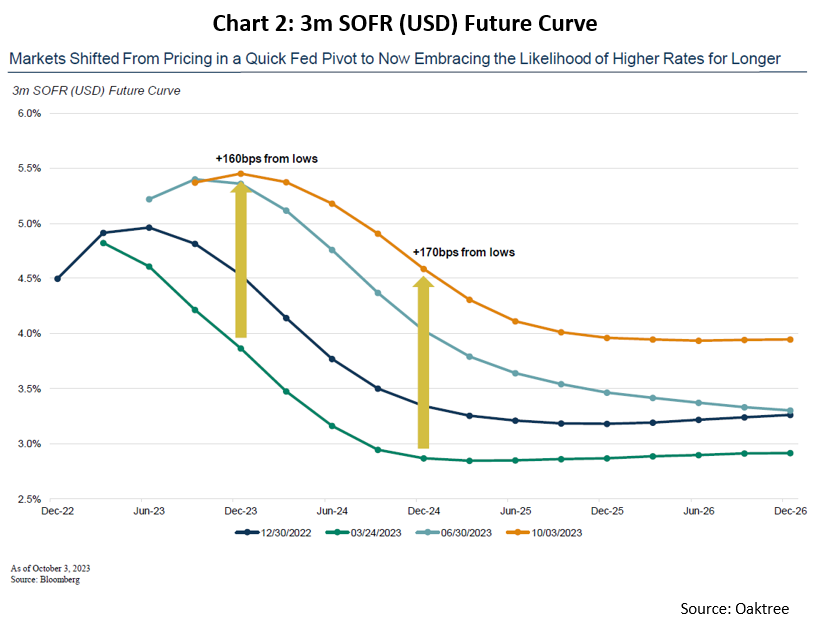

Over the past year, the market has continued to shift from pricing in a quick Fed pivot to embracing the likelihood of higher rates for longer (See Chart 2)

Yield Curve Madness – Why Are Long Yields Surging?

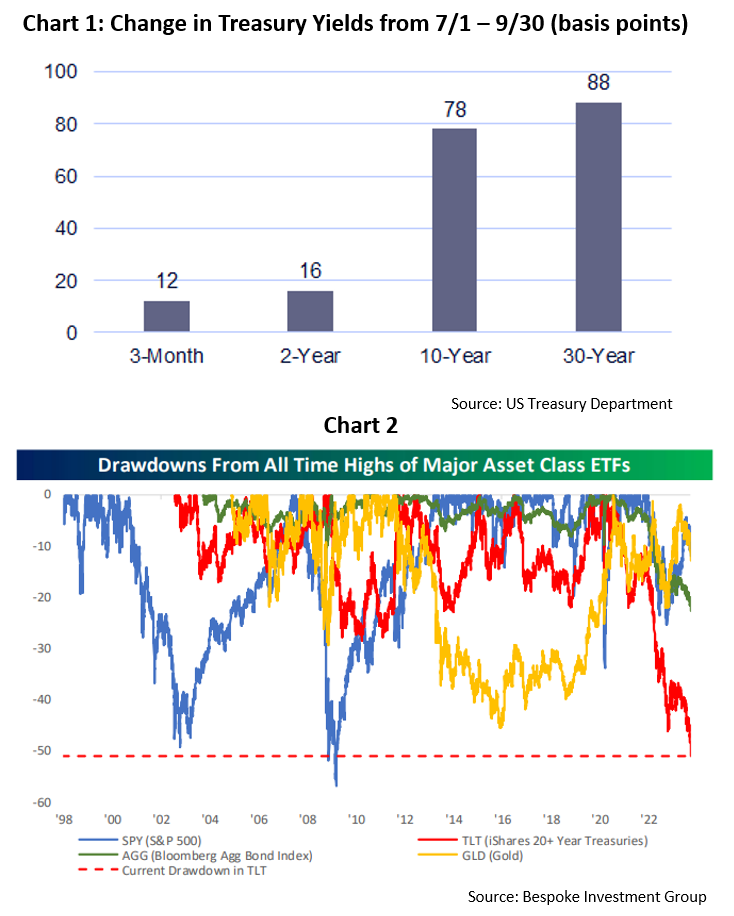

The steepening of the yield curve has been led by the surge in long-term Treasury yields. At the short-end of the curve, 3-month and 2-year yields are up 12 and 16 basis points since July 1st. But 10-year and 30-year Treasury yields have surged 78 and 88 basis points, respectively. (See Chart 1) Particularly concerning is how long-duration US Treasuries have not been rallying on good news. Instead, long-term Treasuries (as measured by the iShares 20+ Year Treasuries ETF) have experienced a drawdown exceeding 50% from their August 2020 highs. (See Chart 2)

Why are long-term yields surging? Below we highlight the major reasons:

- Downgrade of US Credit Rating, Increasing Deficits & Treasury Issuance: Fitch joined Standard & Poor’s on August 1st by downgrading the US Credit Rating to AA+. Ballooning debts and deficits are spooking investors and resulting in higher compensation in long-term yields. Rising deficits have already led to increased Treasury issuance. In 2024, Treasury Auction sizes are expected to increase on average 23% across the curve.

- Government Shutdown: A possible Government Shutdown is adding to worries that Washington can’t get its finances in order. The market was expecting a government shutdown on October 1st, but the House surprised markets with a 45-day continuing resolution to keep open the Government – which cost Speaker Kevin McCarthy his job.

- Fed Quantitative Tightening (QT): The Fed continues to be seller of US Treasuries, shedding nearly $1 trillion in bonds since June 2022. This leads to upward pressure on government yields.

- Japan Exiting Yield Curve Control (YCC): The Bank of Japan (BoJ) announced greater flexibility in its YCC to allow yields to rise as high as 1%. Japan is the world’s largest holder of Treasuries and higher yields could result in Japanese investors selling Treasuries.

- China Selling US Treasuries: China’s ownership of US Treasuries has dropped to roughly $800 billion, its lowest level since 2009. One reason for the selling has been to help China defend its weakening currency.

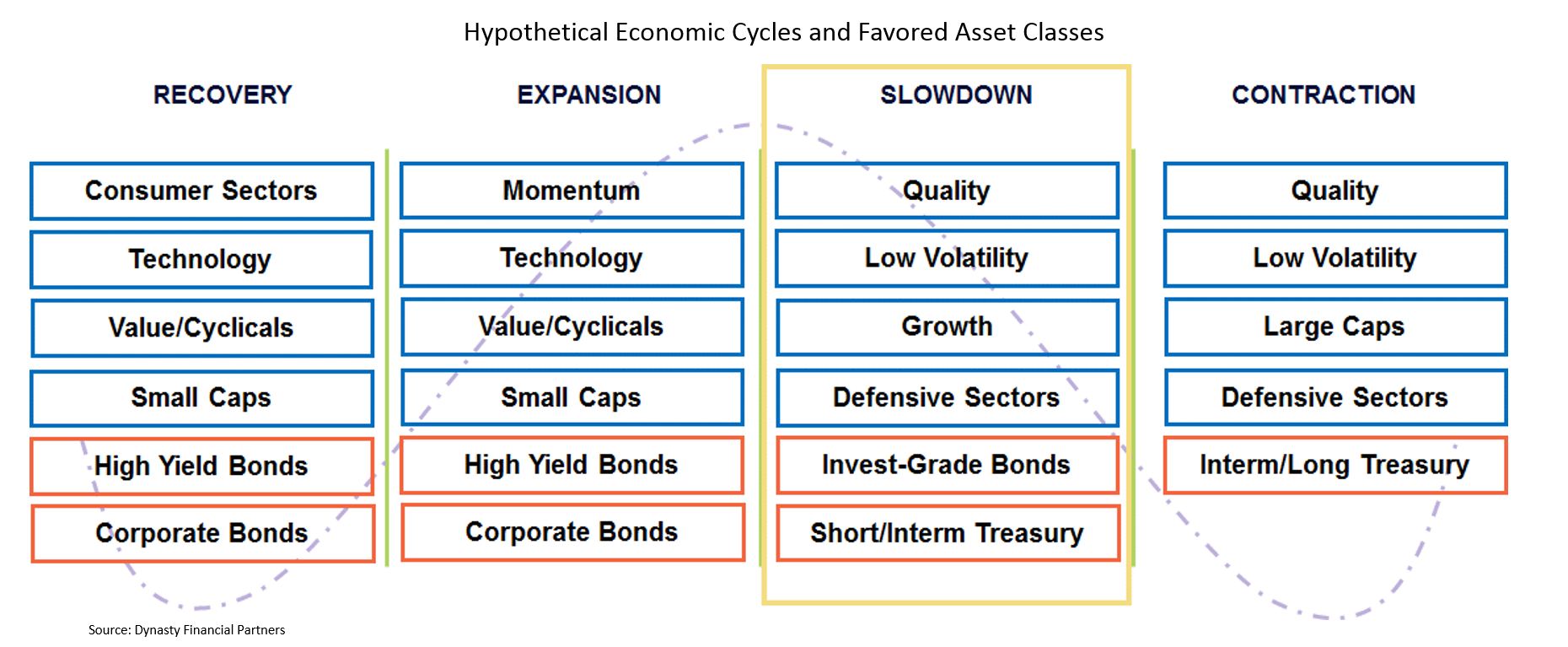

Investing in a Late-Cycle Environment

We believe the economy is approaching a Fed-induced slowdown. Ultimately the Fed will not stop hiking rates until the labor market cools, unemployment rises, and Fed members feel confident inflation is on its way back to its 2% mandate. As the economy slows down, we favor tilting equity portfolios towards High Quality and Low Volatility stocks, as well as Growth over Value. In terms of Fixed Income, we continue to favor high quality corporate bonds and short duration Treasuries. As the economy starts to slow, we believe investors can gradually extend portfolio duration.

Investment Implications

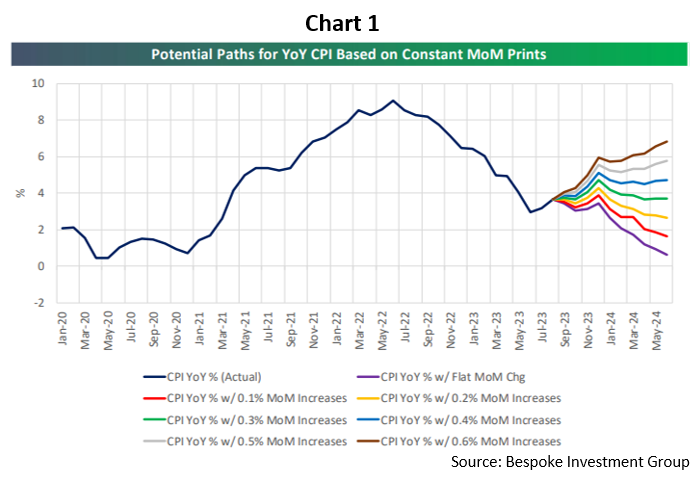

- Hope for a Soft Landing, but Prepare for a Hard Landing. Our original forecast at the beginning of the year of “higher for longer” rates has panned out. We expect CPI to remain sticker between 3.0%-4.0% for the remainder of the year. (See Chart 1) The Fed is determined to get inflation back down to its 2% goal, and will use hawkish rhetoric or even another rate hike in 2023 to accomplish its goal. We believe we are approaching a slowdown.

- Utilize the “slowdown” playbook on the previous slide: We favor high quality stocks with top-line growth, strong margins, low-leverage, consistent cash flow generation, low earnings volatility in defensive industries

- Don’t Fight the AI Secular Wave, but Don’t Chase Either. Tech stocks have come under pressure in August & September along with the overall market. Despite the selloff, we would not be surprised to see Tech lead the market higher in Q4. We caution investors who are underweight Artificial Intelligence, as we believe this secular theme is still in the early innings. Investors have also utilized Big Tech as a flight to safety over Utilities & Staples – a trend that may continue in Q4.

- Fixed Income is attractive, particularly the short-end of the yield curve: Yields have run up significantly, with the 2-Year yield at the highest levels since 2006. The Fed controls the short-end of the curve and is nearing the end of its rate hiking cycle, which could result in lower yields. In addition, possible labor market softness and a slowing economy in Q4 could benefit long Treasuries, rendering them as a good hedge vs. an equity market correction

- Cash is still king: As stated, uncertainty remains between a hard landing and a soft landing at the end of the current rate cycle. With cash earning a ~5% yield, we like having above average cash balances as dry powder to opportunistically deploy when there are market dislocations without denting returns

- US over Rest of the World: Economic news in Europe has been less encouraging than in the US, both on growth and inflation. Moreover, China’s economic troubles may have a large impact on Europe – Germany is the largest exporter to China in Developed Europe. Geopolitical issues (e.g. Ukraine, Israel) keep us on the sidelines when it comes to Emerging Markets. Despite being relatively overvalued, we like US over Rest of the World.

- Add alternatives to traditional 60/40 portfolios: Against the backdrop of rising rates, slowing growth and sticky inflation, it would make sense to diversify portfolios by adding exposure to alternatives that have historically exhibited low correlation to public markets. We particularly like Private Credit. Banks have been under pressure to shore up their balance sheets and cut bank on lending. This has provided a huge opportunity for Private Credit to fill in the gap.

Important Disclaimers and Disclosures

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from MAXIMAI Investment Partners and Dynasty Financial Partners, who reserve the right at any time and without notice to change, amend, or cease publication of the information contained herein. MAXIMAI is providing this market update for informational purposes. Although this information has been prepared from sources we believe to be reliable, MAXIMAI has not in all cases independently verified such information. The views expressed in the referenced materials are subject to change based on market and other conditions. This document may contain certain statements that may be deemed forward looking statements. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

The information provided does not constitute investment advice and is not a solicitation to buy or sell securities. This market update does not take into consideration an investor’s specific investment objectives or risk tolerance. Investments, products, strategies or services discussed are not intended for offer, sale or distribution in countries or jurisdictions where not permitted by applicable law. This content may not be modified, distributed or otherwise provided in whole or in part without MAXIMAI’s express authorization. Nothing in these materials is intended to be, and you should not consider anything to constitute investment, accounting, tax or legal advice.

All investments carry risk of loss. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, investment model, or products, including any investments, investment strategies or investment themes referenced in these materials, will be profitable, could be achieved or that similar results could be attained in the future, be suitable for a particular portfolio or individual situation, or prove successful. Investment results will fluctuate and may be highly volatile, particularly over the short term. Diversification does not protect against loss. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions.

Investments or strategies discussed in this presentation, such as private offering or private equity may be speculative, illiquid and carry a certain degree of risk that may only be borne by those who understand and can sustain the risk of loss of their entire investment. The possibility exists that there may not be a secondary market for certain investments and clients should be prepared to bear the risk of holding their investment indefinitely, without the possibility of selling. ETFs or Exchange Traded Funds, are marketable securities that track an index, commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, ETFs trade like common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. Mutual Funds and ETFs are sold by prospectus/offering document. Please consider the investment objectives, risk, charges and expenses carefully before investing. The prospectus/offering documents, which contains this and other information, can be obtained by contacting your Advisor. Read the prospectus/offering documents carefully before investing. MAXIMAI is an SEC registered investment advisor located in Coral Gables, Florida. Any references to the term “registered investment advisor” or “registered” do not imply that MAXIMAI or any person associated with MAXIMAI have achieved a certain level of skill or training.